how much does nc tax your paycheck

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. The information provided by the Paycheck Calculator.

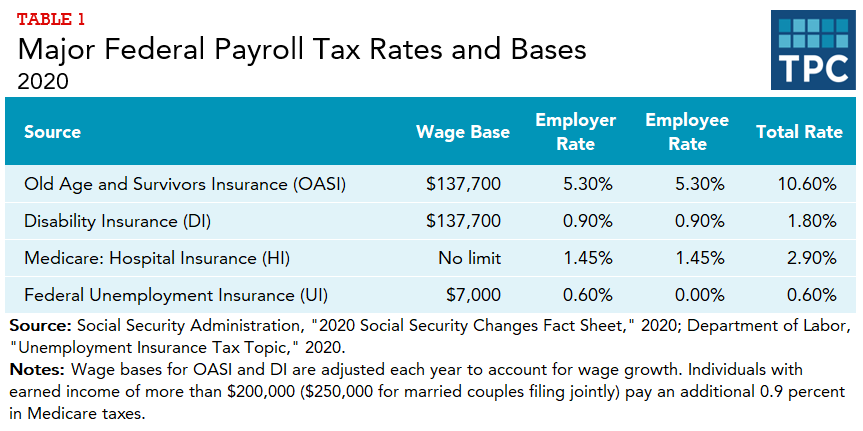

2022 Federal State Payroll Tax Rates For Employers

North Carolina has not always had a flat income tax rate though.

. North Carolina Salary Paycheck Calculator. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. Social Security income in North.

North Carolina has a flat income tax of 525. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Detailed North Carolina state income tax rates and brackets are available on.

Once an employer is eligible to receive a reduced tax rate the tax rate is determined annually based on. Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies.

Take Your 2019 Standard Deduction. When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

Here you can find how your North Carolina based income is taxed at a flat rate. North Carolina Gas Tax. Minimum Wage in North Carolina in 2021.

Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. Any wages above 147000 are exempt from. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing.

After a few seconds you will be provided with a full. North Carolinas UI tax rates are determined under an experience rating system. It will calculate net paycheck amount that an employee will receive based on the total.

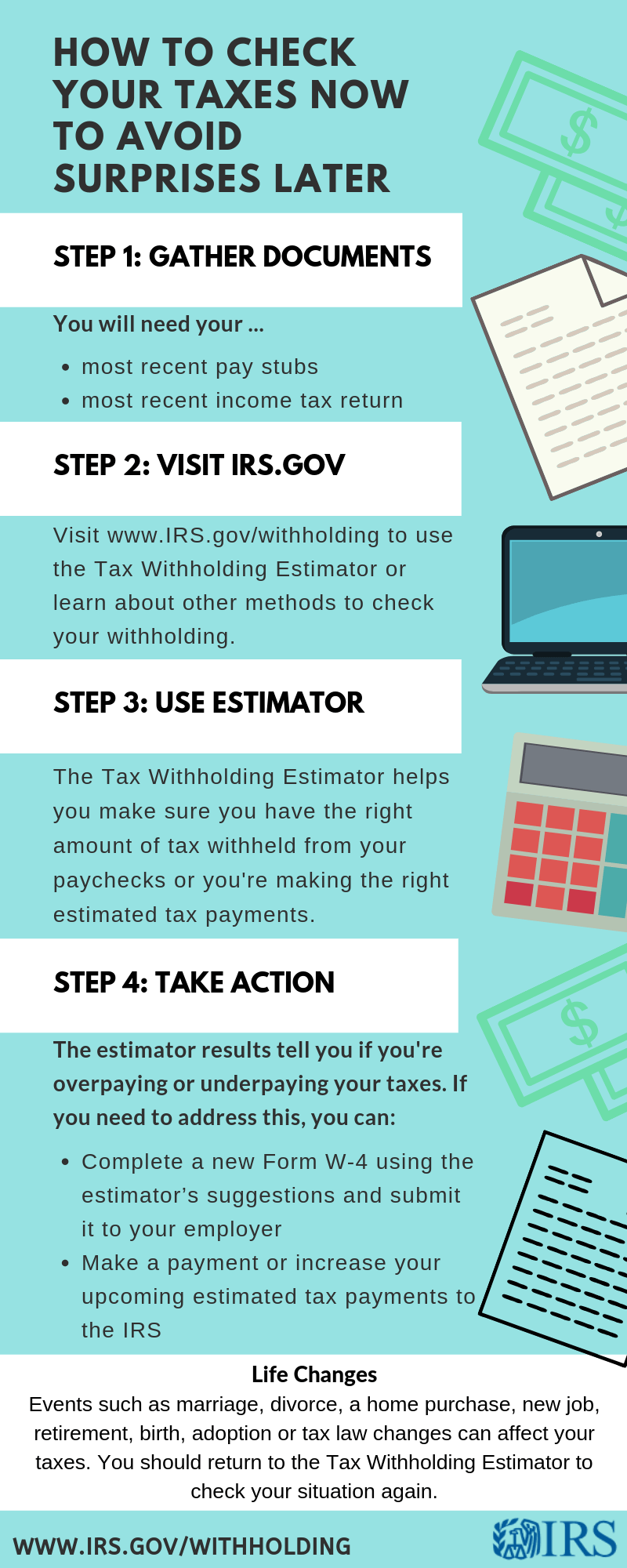

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance. Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax Motor Carrier Tax IFTAIN Privilege License Tax Motor Fuels Tax.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. For example for 2021 if youre single and making between 40126 and 85525 then you are responsible for paying 22 percent of your. North Carolina Income Tax Calculator 2021.

Payroll check calculator is updated for payroll year 2022 and new W4. Learn North Carolina income tax property tax rates and sales tax to estimate how much youll pay on your 2021 tax return. How Much Does Nc Tax Your Paycheck.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Hourly non-exempt employees must be paid time and a. Gross income means all income you received in the form of money goods property and services that isnt exempt from tax including any income from sources outside.

Your average tax rate is 1198 and your. Overview of Tennessee Taxes Gross Paycheck 3146 Federal Income 1522 479 State Income 499 157 Local Income 350 110 FICA and State Insurance Taxes 780. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

North Carolina Paycheck Calculator.

How To Organize Tax Records Tax Organization Blog Organization Organization

Move Transactions From Mint To Quickbooks Self Employed Quickbooks Quickbooks Online Payroll Taxes

North Carolina Providing Broad Based Tax Relief Grant Thornton

How To Understand Your Paycheck Youtube Personal Financial Literacy Financial Literacy Understanding Yourself

2021 Federal Payroll Tax Rates Abacus Payroll

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

2022 Federal Payroll Tax Rates Abacus Payroll

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pin On Bandz Bread Green Backs

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

5 Bank Accounts Your Family Needs Bank Account Accounting Budgeting Money

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Us Taxes Abroad For Dummies Update For Tax Year 2018 Rockville Md Us Tax Tax Rockville

North Carolina Paycheck Calculator Smartasset

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)