what is suta taxable

Its also known as state unemployment insurance SUI. After the first 700000 employers do not have to pay any further taxes.

Suta State Unemployment Taxable Wage Bases Aps Payroll

If an employee makes 60000 their.

. An employer has a positive reserve ratio when total taxes paid exceed the total unemployment. Equal Opportunity is the Law. The maximum FUTA tax an employer must pay per employee per.

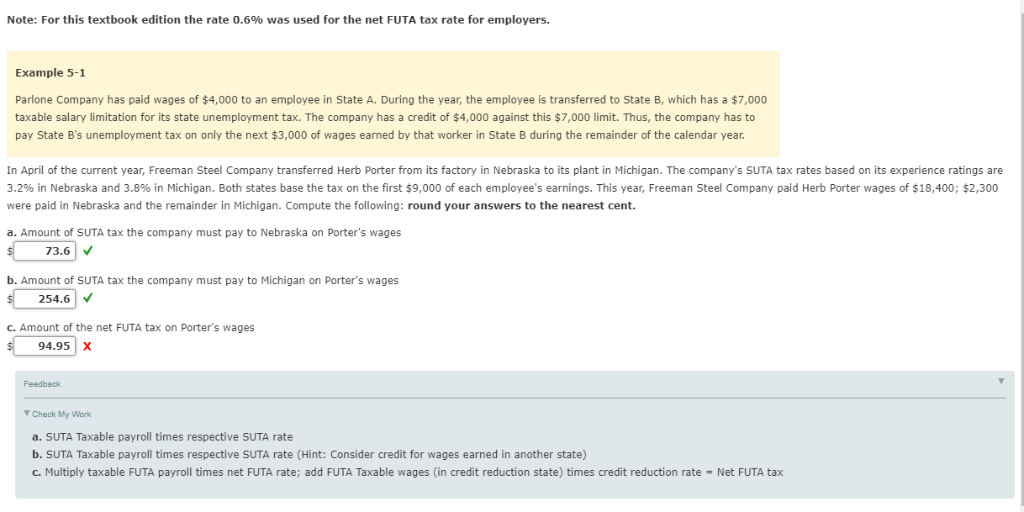

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Arkansas unemployment insurance tax rates currently range from 01 to a maximum rate of 50 plus the stabilization rate in effect for the current year. The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers.

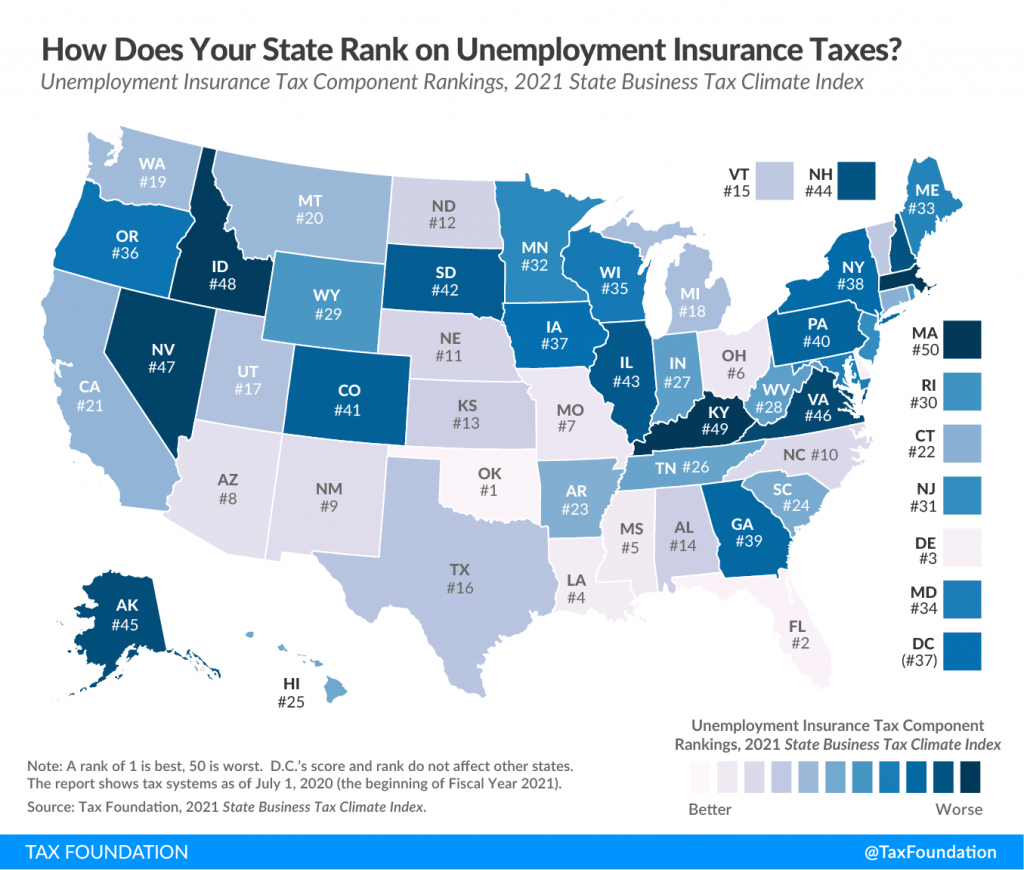

Each state decides on its SUTA tax rate range. As mentioned in some states employees contribute to SUTA but in all states the employer pays SUTA taxes. In some cases however the employee may also have to pay.

SUTA is a payroll tax required from employers. What is SUTA. The FUTA tax rate is 60 of the first 700000 of an employees wages during the year.

Accumulated Total Taxes Accumulated Total Benefits Reserve Ratio Average Taxable Payroll. SUTA isnt as cut and dry as the FUTA as it varies by state. These taxes are placed in a states unemployment fund.

The ranges are wide. The upper range indicates that. SUTA stands for State Unemployment Tax Act.

Each state establishes its. The states requiring employee contributions are Alaska New. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

The FUTA and SUTA taxes are filed on Form 940 each year. Kentuckys range for example is 03 to 9. State Unemployment Tax Act SUTA Indiana Code 22 Article 4.

Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

If an employee makes 18000 per year their taxable wage base is 18000 and their employer calculates SUTA based on this amount. Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. Fortunately most employers pay little SUTA tax if they.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. To calculate the amount of unemployment insurance tax. Additionally wages earned by employees younger than 21 are not required to be taxed.

Unemployment Insurance Employer Handbook. General employers are liable if they have had a quarterly payroll of 1500. Assume that your company receives a good assessment and your.

Government employers nonprofits educational and charitable institutions are exempt from these taxes. New companies usually face a standard rate.

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

2022 Federal State Payroll Tax Rates For Employers

State Unemployment Tax Act Suta Bamboohr

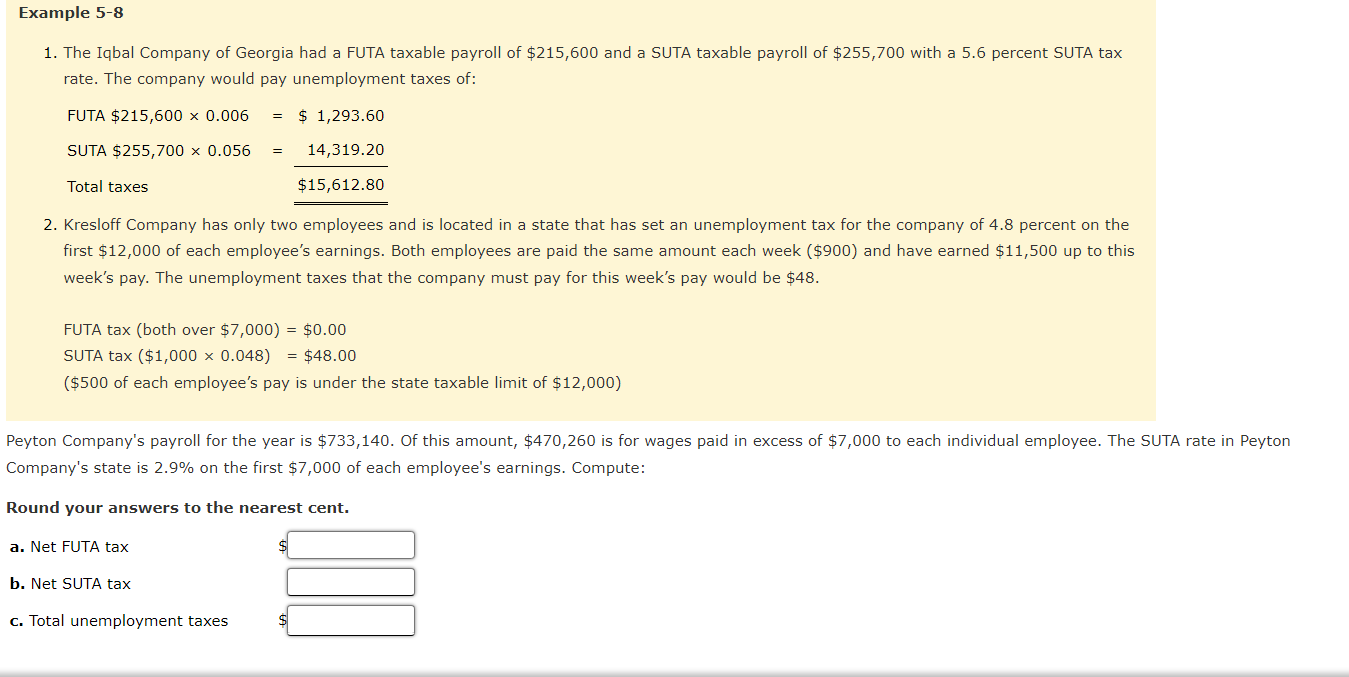

Solved I Need Help With C Please I Cannot Figure Out How Chegg Com

2018 Unemployment Cost Facts For Washington First Nonprofit Companies

Note For This Textbook Edition The Rate 0 6 Was Chegg Com

Employer Taxes 101 Fica Futa Suta Decoded

Chapter 5 Homework Docx Chapter 5 Homework Since The Suta Rates Changes Are Made At The End Of Each Year And There Is Much Discussion About Changes To Course Hero

2022 Federal Payroll Tax Rates Abacus Payroll

State Unemployment Tax Suta How To Calculate And Pay It

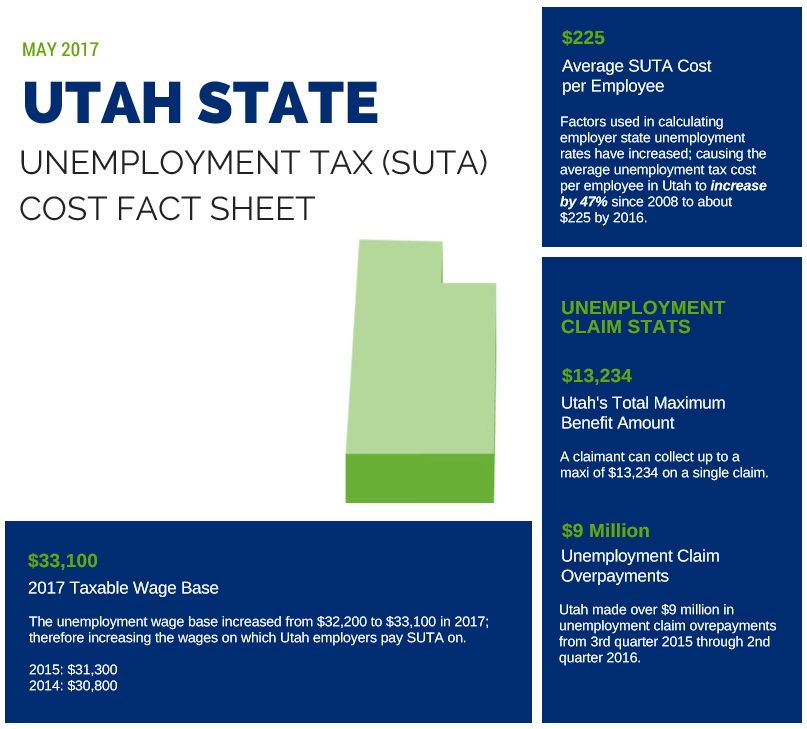

Fast Unemployment Cost Facts For Utah First Nonprofit Companies

Oed Unemployment Ui Payroll Taxes

.jpg)

16367 Az No State Withholding On Payroll Check Das Jpg

Solved Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S

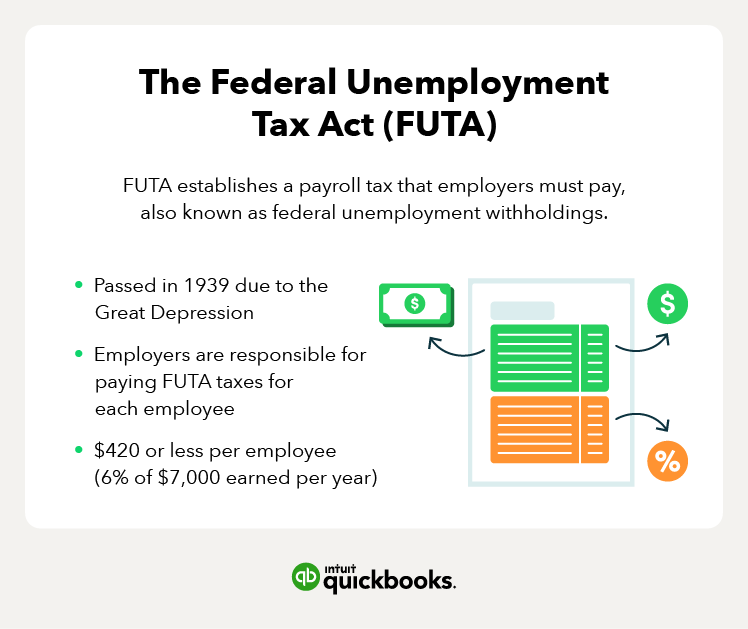

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks